"He even gave me a reference number"

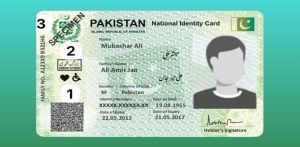

A new wave of scams involving fake banking apps is catching out unsuspecting sellers across the UK.

These apps mimic legitimate mobile banking platforms and allow fraudsters to fake bank transfers in person, show the seller a “successful payment” message and then walk away, leaving sellers thousands of pounds out of pocket.

Dr Tim Day, lead in doorstep crime and scams for the Chartered Trading Standards Institute (CTSI), described the apps as an “emerging threat”.

He added: “The in-person nature of this scam is unusual.”

Anjali Gupta* was selling a camera on Facebook Marketplace when a buyer arrived.

The buyer showed a fake Santander banking app screen and convinced her that a £500 bank transfer had been completed.

She recalled: “He even gave me a reference number and said it sometimes takes a while for the money to arrive.”

However, the money never arrived, and the scammer disappeared with the camera.

Manoj and Meera Chauhan* were selling their Mercedes on Facebook Marketplace when a fraudster used a fake Lloyds banking app to deceive them into handing over the car keys.

The fraudster claimed it may take up to two hours for the £14,250 to appear in their bank account.

He took the Mercedes, and for a few days afterwards, he promised the money had been sent.

However, the couple were left devastated when their bank account revealed the transaction didn’t exist.

In the past three years, approximately 500 crime reports involving fake banking apps have been made to Action Fraud.

Previously, some of the apps were available on the Google Play Store but were removed, with Google saying the “safety and security of users is our top priority”.

However, versions of the apps are available online and they can be downloaded directly to Android phones without the use of an official app store.

Dr Day said: “So much of fraud is now happening online that it’s easy to drop our guards when dealing with people in person.

“It gives us a false sense of security but fraud and scams are just as likely to happen in this space.”

Dr Day said it also shows how scams are becoming “more complex and sophisticated”.

He added: “The amount of money which is available as a result of fraud is so huge and the relative levels of enforcement possible means it’s a crime type which is attracting more and more professional criminals.”

He said that tech companies need to be “more engaged” in driving out fraud on online platforms.

How to Avoid the Scam

UK Finance gave the following safety advice:

- Do not be pressured into accepting payment by bank transfer.

- Never hand over goods unless you are sure you have received the money and check your own bank account to see if the payment has arrived.

- Check if the buyer has a newly registered profile before you meet them as this may mean they are not who they say they are.

A government spokesperson said they were taking “ambitious steps to tackle the evolving threat of fraud”.

They added: “In the coming months, we will set out further details including plans to strengthen international cooperation, introduce better protections against AI-enabled fraud, and increase collaboration between government and the private sector.”