"Pakistan has refused to comply with this final non-appealable court decision"

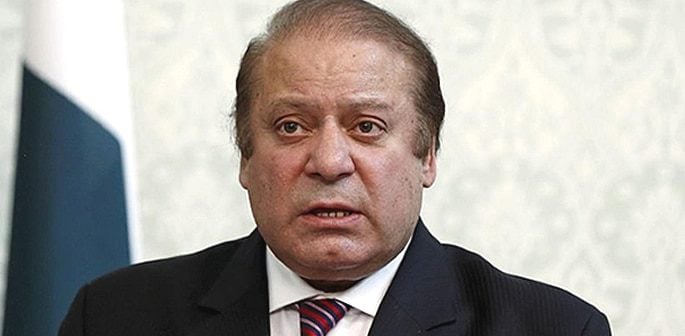

The Pakistani government is facing a £17 million claim after they failed to pay for tracking down a series of London flats once owned by the country’s former Prime Minister Nawaz Sharif.

Asset recovery firm Broadsheet made the claim against the country and its anti-corruption agency, the National Accountability Bureau (NAB) to the high court.

It intends to apply to take possession of Avenfield apartments, four luxury flats on Park Lane, Central London. They had been the homes of Sharif’s family.

Sharif was jailed for 10 years in July 2018 on corruption charges. He is appealing his conviction from a prison in Islamabad.

The apartments were used to raise a £7 million mortgage and is estimated to be worth over £8 million today.

Sharif’s case easily highlighted how London’s property market could be used to move money from abroad.

Washington-based law firm Crowell and Moring represent Broadsheet. Senior partner Stuart Newberger explained that the high court previously ruled that Pakistan owed his client around £17.9 million for obtaining help in locating Sharif’s corrupt assets.

He said: “Pakistan has refused to comply with this final non-appealable court decision, thus requiring Broadsheet to enforce this order by seizing Pakistan’s assets.”

Documents stated that Sir Anthony Evans QC ruled in December 2018 that the Pakistani government and the NAB owed Broadsheet £17.5 million.

Broadsheet’s reading of the asset recovery agreement was also upheld by Evans.

This entitled it to 20% of any assets recovered from the targets, regardless of whether the assets were found abroad or in Pakistan.

The NAB was established in 1999 by General Pervez Musharraf. It was to investigate corruption allegations against public officials.

In the year 2000, Broadsheet joined up with the NAB and agreed to help locate assets belonging to Sharif and over 200 other politicians.

The work was completed by the firm in return for 20% of any sums recovered from the assets.

In 2003, the agreement ended but Broadsheet’s owner Kaveh Moussavi stated that he found out that the NAB had secretly entered into settlements with Sharif and others.

Sharif returned to Pakistan after spending seven years in Saudi Arabia. In 2013, he became prime minister for a third term.

He was subsequently disqualified from public office in July 2017 following the Panama Papers leak.

The leaks linked Sharif’s children to the purchase of London flats through offshore companies in the British Virgin Islands during the mid-1990s.

It was assumed that Sharif made the purchases as the children were still minors.

He was accused of using several transactions and shell companies to send the proceeds of public funds into assets abroad.

While the court ruled that his ban should be for life, he still faced multiple criminal proceedings.

Sharif, his daughter Maryam and son-in-law Safdar Awan were convicted of corruption in July 2018. It was in relation to the series of London flats.

The ex-PM and his daughter were both arrested after landing in Lahore. Sharif was jailed while Maryam’s sentence was suspended. They deny any wrongdoing.

The Guardian reported that Sharif was investigated as part of a campaign against corruption promised by Imran Khan.