"We grew the business to a good profitable margin."

Most East African Asians who had flourishing businesses in Kenya and Uganda had to make a fresh start after settling in the UK.

According to settlement, businesses were spread primarily over East and West Midlands as well as parts of Greater London.

Many started small businesses, which were progressively expanding. There were others that invested on a much bigger scale, with business operations across Europe and further afield.

Despite facing economic hurdles and other challenges, most East African Asians and their respective families successfully reclaimed what they left behind in Kenya and Uganda.

Over a period of time, businesses ran by East African Asians succeeded in integrating as a whole.

DESIblitz analyses the contribution of East African Asians across the business field in the UK and the challenges that they were up against.

Business: Entrepreneurs Recreating the Magic

Many East African Asians with prosperous businesses in Kenya and Uganda had to make a restart after making Britain their new home.

The majority were in self-employment, being their own bosses when residing in East Africa also.

Thus, after finding their feet and settling predominately in the Midlands and Greater London, many of them went into business.

A fairly large number of Gujarati and Punjabi families decided to invest in the retail sector.

Giving a new lease of life, they ran grocery stores, newsagents and corner shops.

Others began investing in manufacturing and operating businesses. These were on a much larger and in some cases global scale.

From the late 60s and onwards, entrepreneurial Ugandan Asians had a major role in revitalising the economy of Leicester.

The contribution of Ugandan Asians was pivotal during a period when businesses were closing.

With an enterprising nature, many Asians that were living in Leicester had taken over slumping shops and businesses.

The success of businesses run by British Asians of East African origin has been well recorded by researchers and academics.

Anthropologist, Dr Steven Vertovec highlights the historical importance of refugees in the Journal, Innovation (1994).

He observes that Ugandan Asians came to the UK with an eye for business, a good educational background and transferable skills.

Hence, it was easy for them in adapting to the local economy by developing a prosperous Asian business sector.

Professor Gurpahal Singh (2003) offers his thoughts within Ali, N, Kalra, VS, and Sayyid, S Postcolonial People: South Asians in Britain (2006).

Singh encapsulates that many businesses had “substantial transnational trading links with Europe, South Asia and North America.”

Leicester was particularly thriving in the knitwear trade, with many businesses having clients across the world.

Singh also sheds light about the success of ethnic businesses in a city where people are familiar as the ‘Foxes’:

“Ethnic business success in Leicester is symbolised in the Belgrave Road “Golden Mile” which has become a retail and commercial centre of international renown.”

Therefore, the goodwill that the East African Gujarati and Sikh communities from Leicester had was important in positively changing the fortunes of Belgrave Road.

Karen Chauhan, a visionary known in Leicester summarises what she describes as the Leicester ‘model.’

She said that East African Asians despite struggling and facing racial opposition, had the determination to transform deprived areas like Belgrave.

The successful transition also saw the creation of approximately 30,000 jobs in the city. Melton Road was the other big spot for Asian businesses such as Kampala Jewellers.

The East African Asian community in Leicester also had a big impact on the food industry.

Historian Panayi Panikos notes about the entrepreneurial acumen of Asians in Kershen, Anne J, Food in the Migrant Experience (2002).

Panikos cites that Asians were operating a door-door service supplying specialist food and spices.

This was definitely a confidence booster for the Asian community, particularly in terms of their business growth.

The situation was very similar in the Midlands, with many East African, Asian settlers going into business.

They initiated businesses such as newsagents, takeaways, car repair garages, clothing, printing, plumbing, insurance, building and electrical outlets to name a few.

London was very much the same as the Midlands belt.

It was through a business that many Asians originally from Kenya and Uganda regained what they may have lost in East Africa.

The migrants were able to purchase big houses worth half a million pounds, along with top of the range cars.

Business Success and Challenges

After fleeing Kenya and Uganda many Punjabi and Gujarati individuals eventually went on to become successful businessmen in the UK.

Initially, many had a dilemma at the start when arriving in the UK. Consequently, to begin with, some were working on a part-time basis or as contractors.

Slowly, as East African Asians became financially sound, they were able to set up businesses on a national level.

Many eventually went into the same business they were trading or had skills in East Africa.

At 42, the multi-millionaire industrialist Manubhai Madhvani (late) was left with nothing after Ugandan dictator Idi Admin forced him into exile in 1972.

Following his brother’s death, the Jinja-born businessman had taken over the family empire, the Madhvani Group of Companies.

Despite escaping Uganda and coming to the UK in difficult circumstances, he went on to become the 9th richest Asian man in the UK.

With global business interests in sugar, brewing and tourism, during 2001 he was worth £190 million.

Let’s take a closer exclusive look at several other individuals who are part of the Aidem Digital and DESIblitz.com documentary: From Africa To Britain.

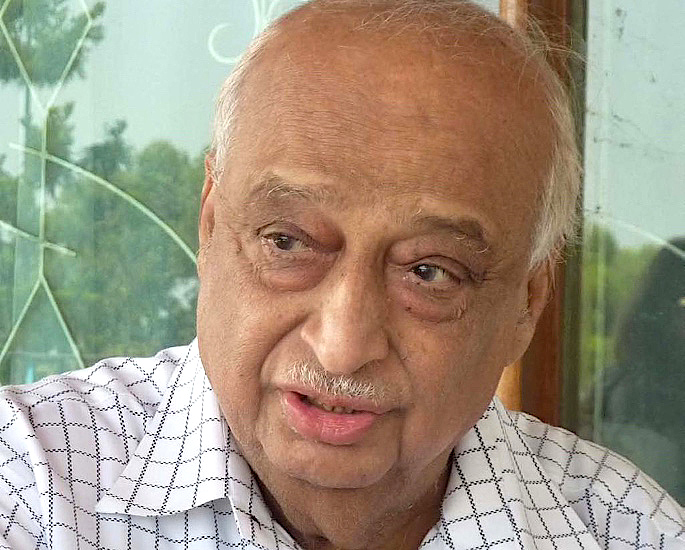

Jaffer Kapasi

Jaffer Kapasi who was born in Masindi, Uganda came to the UK with £55 to his name. This is after being expelled by Amin in 1972. He made his fortune in Leicester.

After completing university and training as an accountant, he established a financial consultancy business. Speaking about his business journey, Kapasi comments:

“I started working from home in Oadby in 1968. I had a few clients working from home and started getting more clients. And then set my up by first practice again in Oadby.

“I started getting more clients and I started employing more staff. And eventually, after a few years,

“I bought an office building in Ross Walk in Belgrave.”

“Again I employed a few staff and carried on my accountancy practice.”

The Honorary Consul General of Uganda has also previously taken on the role as head of the Leicester Asian Business Association (LABA). He later was also a treasurer for LABA.

Recognising his services to the business world, Kapasi went on to receive an OBE in 1997. Daily Mail reports that his two brothers were in the hardware business also.

Jaspal Singh Bhambra

Jaspal Singh Bhambra, originally from Uganda embarked on his British adventure in Thornton Heath, London.

After moving to Birmingham, Jasbir started his electrical business in 1975. In the beginning, Jasbir and his dad were installing electrical meters within small houses.

Jasbir tells us “there was good money in that.”

After briefly working with one sibling, he found SND Electricals on April 5, 1982, along with his two brothers.

It made sense, as his family began their humble beginnings in the electrical trade from Kenya, during 1929-1930. Shedding more light on being a specialist and having a fruitful business, Jasbir says:

“Our name SND is a household name in electricals. And we cater practically every item that people cannot get anywhere. We specialise in those.

“I set up the business with my two other brothers. We grew the business to a good profitable margin.”

All his extended family are also in the electrical trade. The new generation of the family saw the launch of SND Lighting in 2001.

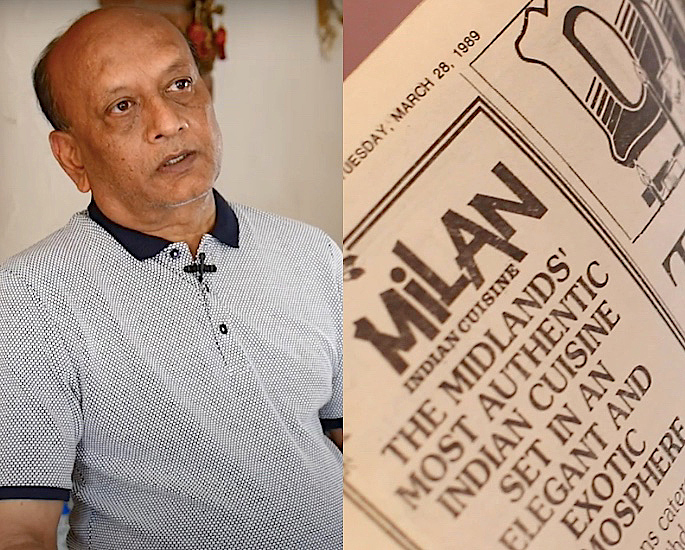

Dhiren Patel

Mombasa-born Dhiren Patel from Birmingham had to juggle his education and doing odd jobs during the day-night after arriving from East Africa.

By 1974, he opened Milan Sweet Centre, a confectionary shop in Birmingham. When asked about any tough situation surrounding the business, he exclusively replied:

“The only challenges were looking for a premise, applying for it and getting a licence. That was the difficult part.”

Since then, there was no looking back for Dhiren and his family as they just got on with it.

Two years later, in 1976, they also began a catering service, which came to a halt in 2011.

The sweet centre going strong for over fourty-five years is a testimony to what Dhiren terms as “consistency.”

Dhiren is taking somewhat of a backseat, whilst other family members run the day-to-day side of the business.

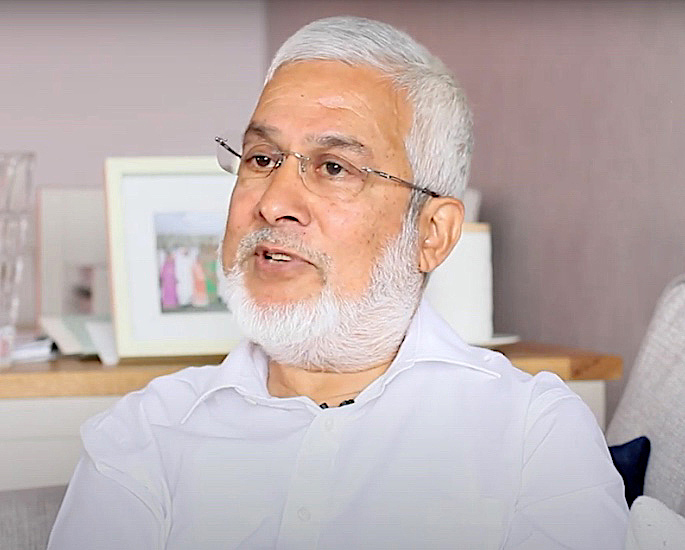

Dr Sarindar Singh Sahota

Engineer Dr Sarindar Singh Sahota was born in Nairobi but is a British national too.

After graduating from Birmingham University in 1971, Sarindar points out that he made the decision to go into business as employment was offering very little pay.

Sarindar felt he could earn more than £1200 per annum. So, he went back to Kenya and became involved in the family business.

From then on, Sarindar was in business, working and shifting between Kenya and the UK.

Sarindar has previously held various prominent positions, leading the business sector. These include being Vice-Chair of the West Midlands Regional Assembly and Deputy Chair of West Midlands Business Council.

Sarindar also presided the Single Regeneration Budget Round 6 N W Birmingham, guiding it to successful completion. This was a regeneration scheme worth £40 Million.

In addition, Sarindar was the former chair of Asian Business Forum (ABF) and Institute of Asian Businesses (IAB).

Acknowledging his services to regeneration, Sarindar was honoured with an OBE in the 2005 New Year’s Honours List.

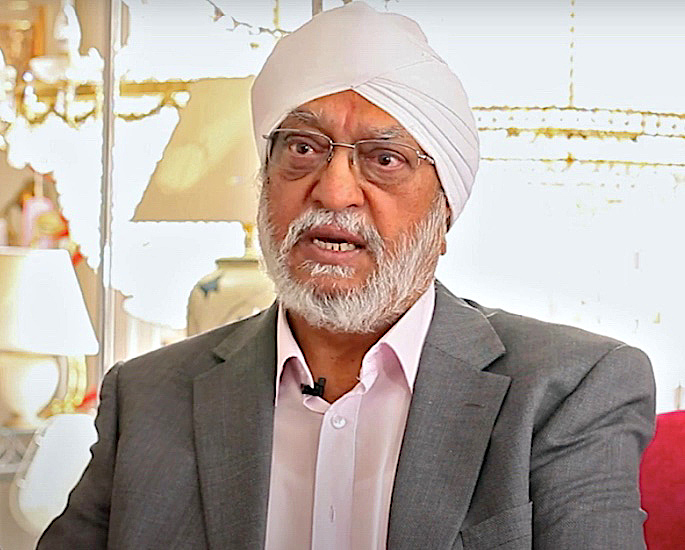

Hardyal Singh Matharu

Hardyal Singh Matharu was born in Dhunki, Kapurthala, Punjab just after the independence of India.

After living in Moshi, Tanzania and coming from Kenya to the UK during 1988, he founded a business as a consultant and builder.

In contrast, to Sarindar, even though the business did well for a year, he had closed it down as a result of payment issues.

Hardyal was fortunate to land himself a job with a National Contractor on a freelance basis. In fact, he was the Chief Engineer for Colmore Gate on Colmore Row in Birmingham.

Hardyal who is an avid Bollywood fan takes life inspiration from a quote by yesteryear singer CH Atma:

“The path of life has many ups and downs. Walk carefully dear, walk with caution. The destination is still very far away.

“Where have you lost your deeds of faith and karma? You shall be questioned upon.”

For Hardyal these couplets are actually the “philosophy of life.”

Dr Saroj Duggal

Born in Mombasa, Dr Saroj Duggal is an East African Gujarati woman who has become known to underwrite in the insurance industry.

In 1971, she took her business further, setting up Crownsway Insurance Brokers Ltd. It was through her business that she was advising individuals and companies about their insurance.

Rose spoke about the motivation behind her business, and wanting a slice of the cake:

“A lot of manufacturers were in problem. They did not know where to go. Where to venture out. How to do the insurance. So I got all the projects.

“I went to Lloyds Syndicate. Hence, became the Llyods Underwriter.”

“[I] started writing the tailor-made policies for individuals and individual companies to support them, to guide them what is insurance. Why should they not claim? Why should they take care of their business?

“I started making a profit for syndicates. But then again I had to put my foot down.

“I said, ‘Ok fair enough. I have made money for yourself. Now I need my share’.”

In 2019, Saroj was awarded an MBE for services to Asian and ethnic minority women.

Model Builders

The Model Builders consist of four brothers – Surjit Singh Bhogal, Jagjit Singh Bhogal, Parminder Singh Bhogal and Parmjit Singh Bhogal

They put their building and carpentry experience into practice after coming to the UK. The four brothers also shared their thoughts.

Parminder explains his father bought “a patch of land” for a business. Whereas Jagjit reveals his dad along with Surjit built the business in Smethwick as they were “doing building jobs.”

Jagjit also said the factory-like business had faced financial difficulties, but over a period of time things did pick up.

Surjeet who was here earlier reiterated similar views to Jagjit, describing the challenging times:

“We spent all the money on the building. So we did not have any material to put in the shop. So we were running out to the banks, asking for money.

“And Barclays Bank said to us, ‘your building is not that valued in Smethwick.’ So, they gave us a hard time. We had to keep borrowing money.

“Then we went to the BCC. They started giving us money. They wanted us to put all our houses on security.

“So after that, Natwest Bank came and brought us from BCC Bank. After that Natwest Bank helped us out a lot.”

As a result, they slowly built the business, before the other brothers came from Kenya.

Parmjit feels that the family stuck to what they were best at. Subsequently, they set about specialising in manufacturing and supplying. This includes windows and their very own tools.

They had a machine at their premises also, as they use to do all kinds of joinery. He further mentions:

“It was a tough ride, but we got through it.”

Watch Jaffer Kapasi speak at Uganda Convention UK here:

The effort of the above individuals and businesses has put everything on the plate for the second and third generations.

They have further integrated and succeeded in existing and new businesses.