"work and home life were blurring madly.”

Self-employed individuals from British South Asian and other backgrounds significantly contribute to the UK economy.

Working as self-employed can take various forms, from freelancing to independent contractors and business owners.

The 2022 ISPE report revealed that the solo self-employed workforce contributes an estimated £278 billion to the UK economy yearly.

Moreover, in 2021, UK government data showed that 16.2% of workers from the combined Pakistani and Bangladeshi ethnic groups were self-employed.

Meanwhile, 11.4% of Indian workers were self-employed during the same period.

Increasingly, there is a focus on work-life balance and work flexibility.

Is the focus on work flexibility and work-life balance leading people to self-employment?

Whatever the motivations, self-employment comes with pros and cons, as DESIblitz explores.

Flexibility and Autonomy

Self-employment allows people to set their hours and choose projects, facilitating a better work-life balance for some.

This flexibility is particularly beneficial for managing personal commitments alongside professional responsibilities.

Danyal* was a self-employed trade plate vehicle delivery driver for over five years and asserted:

“Pros are you get to decide when you want to work, so planning around family and stuff is easy.

“You don’t have to answer to anyone but yourself. I did enjoy the freedom of being my own boss.”

Being his “own boss” was freeing for Danyal. However, having such flexibility and autonomy can be a double-edged sword.

Mariam, who is a content creator, said:

“You get to change your hours if you need to. But you have to force yourself to have some kind of schedule.

“When I started, I wasn’t doing proper set hours, and work and home life were blurring madly.”

Self-employment provides the flexibility to manage work and personal life effectively.

Danyal appreciated the freedom to plan around family, while Mariam valued the ability to adjust her schedule.

Yet, for some, work-life boundaries can blur without discipline when self-employed from home, making time management essential for success.

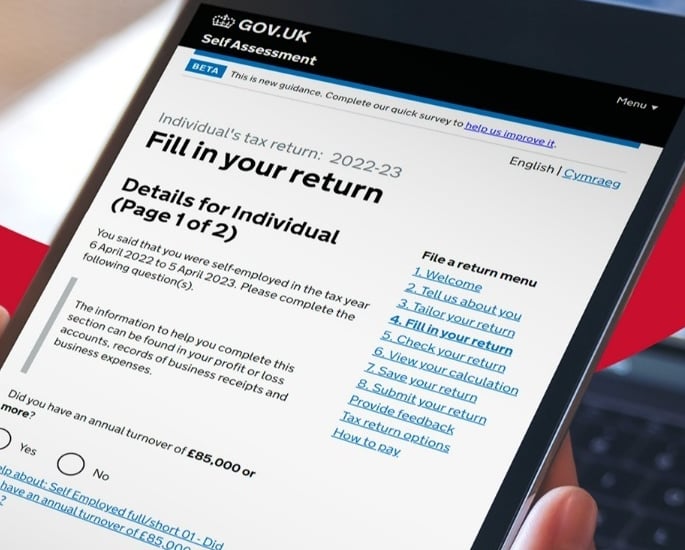

Administrative Responsibilities

Working and running a business as a self-employed individual entails administrative tasks such as bookkeeping, invoicing, and tax compliance.

The self-employed must do it themselves or pay for professional services, which can consume time and resources.

Neelam*, who has been self-employed on and off for four years, stated:

“Only easy thing is creating the invoices and drafting my contracts.

“I have the headache of keeping all my accounts, receipts and records in order.

“Right now, I’m behind on getting my accounts and receipts in order due to life. I haven’t had time.

“It’s another level of stress and annoyance, one mistake and fines later.”

“My friend is lucky her dad runs his own business and helps her.

“Another friend, self-employed in a different sector, makes so much she can pay others to do all that headache stuff.

“I make enough to live comfortably just about. Can’t afford to hire someone to sort out my accounts and things or do my tax forms.”

As Neelam highlights, keeping track of accounts, receipts, and taxes is time-consuming and can be stressful.

While some benefit from family support or have the income to outsource such work, others are left to juggle everything themselves.

Potential for Higher Earnings but Risk of Income Fluctuations

Self-employment offers the opportunity to earn more than traditional employment, as income is, in principle, directly linked to one’s efforts and skills.

Moreover, a person can take on additional work at various times, potentially increasing their earnings.

However, it’s important to note that self-employment income can vary widely.

Research indicates that while some self-employed individuals achieve high earnings, others may earn less than their employed counterparts.

Danyal, reflecting on the negatives of being self-employed, said:

“On the flip side, income can fluctuate a lot from week to week and month to month.”

“Therefore, planning for things can be tricky. If you do need to take days off, you are not earning.”

While self-employment provides the potential for higher income, actual earnings depend on a number of factors.

Factors like industry demand, occupation, competition, individual business acumen, and the state of the economy.

Self-employment offers the potential for financial growth, but income instability is also a reality.

Lack of Employment Benefits and No Employee Rights

Self-employed individuals do not receive benefits such as paid sick leave, holiday pay, or employer pension contributions.

This absence necessitates personal financial planning to cover periods of illness or time off and can lead to stress.

Saima*, who has been a content writer and proofreader for over two years, said:

“For four months, I have been too sick to work. I would be in trouble if it weren’t for my family’s help.

“No income is coming in, and dipping into my savings would mean trouble in the long run.”

“Can’t imagine the stress for those who get sick and don’t have the backup I do.”

Saima’s words show that her family are an invaluable safety net, preventing the acute stress she would otherwise feel over income loss.

The lack of employment benefits in self-employment can create financial uncertainty, especially during illness or unforeseen circumstances.

Furthermore, the self-employed are not entitled to statutory protections like redundancy pay or sick pay.

This lack of security can lead to stress and financial instability during economic downturns, personal emergencies, and crises like the Covid-19 pandemic.

Depending on their circumstances, some self-employed individuals may be eligible for certain state benefits, like Universal Credit or Employment and Support Allowance.

However, the level of support may not fully compensate for the lack of traditional employment benefits.

Tax Benefits and Headaches

Being self-employed can come with tax benefits but also headaches as you are in charge of everything.

In 2024, Ihelem Enterprise Limited highlighted:

“Self-employed individuals in the UK can take advantage of various tax deductions and allowances not available to employees.

“Additionally, you may be eligible for the Flat Rate Scheme or the Annual Investment Allowance, reducing your overall tax liability.”

Self-employment can offer tax advantages, allowing individuals to deduct business expenses and access tax relief schemes.

However, managing taxes can be complex and time-consuming.

Neelam revealed: “Every year I need to do them, I sweat with the tax forms. At least it can be done online, I guess.

“I’ve gotten better at it but got fined the first year. I’m super anal and triple-check, but I still worry I did something wrong.”

For Neelam, the need to do tax forms herself is an undesirable aspect of being self-employed.

Danyal maintained: “You need to put money aside as you have to do your own tax returns.

“It can be time-consuming because you need to have records of all your income and business expenses.”

Self-employment can provide valuable tax benefits but comes with, for example, administrative challenges.

Overall, self-employment offers a range of benefits and challenges for individuals.

It gives flexibility, autonomy, and the potential for higher earnings.

Danyal’s and Mariam’s experiences demonstrate how self-employed people value the freedom to manage their schedules and work on their own terms.

Yet self-employment also brings administrative burdens, potentially fluctuating and irregular income, and a lack of traditional employee benefits. As Neelam and Saima illustrated, this can create stress.

Self-employment can be rewarding but requires careful planning, financial discipline, and navigating uncertainties.