Once valued at over £8 billion during his peak

It’s no secret that being a billionaire in India brings recognition, fame, and attention.

However, stories of success and failure are an integral part of entrepreneurship in the nation’s ever-changing economic scene.

Beneath the glitter and opulence of mass conglomerates, there exist accounts of hardships, in which formerly esteemed magnates face misfortune and legal turmoil.

The tale of these well-known Indian entrepreneurs, who formerly adorned Forbes’ list of billionaires, now sheds light on the shadows left by financial errors.

We will explore the lives of these former titans, following their journey from lofty summits to crashing valleys.

It’s important to note that the wealth of these Indians is subject to change and they may very well enter billionaire status again.

Ranbaxy Singh Brothers

Once lauded as successful businessmen, Malvinder and Shivinder Singh, former billionaires featured on Forbes’ list, faced legal turmoil.

The siblings who inherited a 33.5% share in Ranbaxy, a pharmaceutical company established by their grandfather, opted to liquidate their inheritance in 2008 for £1.5 billion.

Subsequently, their financial decisions led to a gradual depletion of their wealth.

Among their ill-fated ventures was extending a £281,592 loan to spiritual leader Gurinder Singh Dhillon.

The brothers have reported a collective debt of £1.2 million.

Furthermore, they are embroiled in legal battles over allegations of embezzling billions from their financial venture, Religare, and healthcare entity, Fortis.

Their arrest by Delhi Police’s Economic Offenses Wing highlighted a stark fall from grace, with accusations of fund diversion and substantial losses.

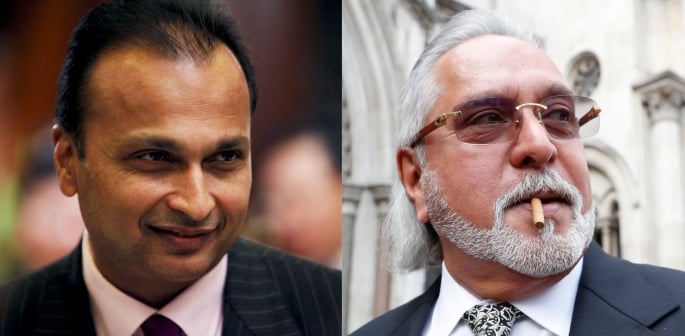

Anil Ambani

Anil Ambani, formerly ranked as the world’s sixth-richest individual in 2008, faced a significant downturn in fortunes, culminating in bankruptcy proceedings in a London court in September 2020.

The flagship companies of his Reliance Group slipped from his control.

Ambani’s financial troubles stem from aggressive debt accumulation for capital-intensive projects across sectors such as power, defence, and infrastructure.

The entry of Mukesh Ambani’s Reliance Jio in 2016 further exacerbated challenges for RCom, leading to defaults on debt and eventual bankruptcy.

Despite attempts to pivot towards the defence sector, setbacks persisted, with legal battles and mounting liabilities heralding the downfall of Anil Ambani’s once-prominent empire.

In February 2020, Ambani declared before a UK court that his net worth was zero, signalling his bankruptcy.

However, there are speculations that this statement was an over-exaggeration.

Jaiprakash Gaur

Led by its 90-year-old founder, Jaiprakash Gaur, the Jaypee Group struggled for survival after enjoying decades of success.

Rising to prominence in the 80s, the group experienced exponential growth between 2000 and 2010 fuelled by real estate, with investments totaling £5.7 million.

However, heavy liabilities began to plague the group in recent years, notably impacting Jaypee Infratech, which defaulted on loans and declared bankruptcy.

The group’s aggregate market value plummeted from £4.3 million in March 2010 to around £650,000 in July 2020.

This was primarily due to mounting debts from risky ventures in roads, power, cement, real estate, and hotels.

Amid declining profits in its cement and hotel businesses and pressures due to falling electricity prices, Gaur is left with two struggling entities, Jaiprakash Associates (JAL) and Jaiprakash Power Ventures (JPVL).

Efforts are underway to salvage these businesses, including potential monetisation of assets.

Nirav Modi

Accused by Punjab National Bank in February 2018 of orchestrating a £1.4 billion fraud, luxury diamond jeweller Nirav Modi has faced international scrutiny.

Allegedly fleeing India in January 2018, he was eventually apprehended in London.

Modi contested the charges, asserting his companies’ lower liabilities.

Modi founded Firestar Diamond, boasting over £1.5 billion in sales, before establishing his eponymous brand, which included 14 stores across global hubs like Mumbai, Hong Kong, and New York.

Previously listed on Forbes’ billionaires list in 2017, Modi’s designs were highly esteemed, even appearing in auctions at Sotheby’s.

The scandal exposed Modi’s alleged swindling of Punjab National Bank over seven years, and according to Forbes, his net worth is less than £90 million

Arvind Dham

Arvind Dham was once the owner of the billionaire company, Amtek.

However, his success started to fall and in an attempt to rescue Amtek Auto from bankruptcy in 2017, Dham sought to divest his wealth.

Despite selling some non-core assets, his efforts fell short of salvaging the company.

Before filing for bankruptcy, Amtek Auto recorded a substantial loss of £194,104 in FY17.

Several subsidiaries of the Amtek Group, including Amtek Auto, Castex Technologies, Amtek Ring Gears, and Metalyst Forgings, also filed for bankruptcy.

Dham’s journey from an original equipment manufacturer for major automotive companies to facing insolvency showcased a once-thriving business that struggled with a cash flow mismatch.

Lenders’ attempts to sell Amtek Auto through resolution processes proved futile, culminating in a petition invoking Dham’s guarantee.

However, the company remains unresponsive to inquiries.

Vijay Mallya

Once revered as the “King of Good Times”, Vijay Mallya, a former billionaire, inherited his father’s liquor business at the young age of 28.

He successfully expanded it into a multibillion-pound enterprise.

However, his fortunes took a sharp turn when he ventured into the airline industry with Kingfisher Airlines.

Despite a promising start, the airline was fragile in the aftermath of the 2008 Recession.

Facing dire financial straits, Mallya resorted to deceptive practices, obtaining loans from banks with insufficient collateral.

As Kingfisher Airlines faltered despite his efforts, revelations of a £845,000 scam emerged, tarnishing Mallya’s once-glamorous image.

Fleeing the country to escape legal repercussions, Mallya resides in the UK, where extradition proceedings are in progress.

Venugopal Dhoot

Despite once boasting a personal wealth exceeding £1 billion in 2015, Dhoot witnessed the collapse of his conglomerate’s major businesses, leading to insolvency proceedings.

In August 2019, the National Company Law Tribunal consolidated resolution proceedings for all 13 group companies, with combined admitted claims totalling £6 million.

Despite offering lenders £2.8 million to halt insolvency proceedings in October 2020, creditors opted to sell assets at a significant loss to Vedanta Group’s Twin Star Technologies.

Dhoot’s endeavours to expand into oil and gas, along with his insurance venture, faced disappointment.

Videocon’s mounting debt and financial struggles, highlighted in Credit Suisse’s House of Debt report, led to insolvency proceedings initiated by India’s bankruptcy court in 2018.

Subrata Roy

Subrata Roy garnered recognition as one of India’s most influential figures, earning a place among India Today’s top 10 powerful individuals.

Instrumental in constructing one of the nation’s largest business conglomerates, he contributed to Sahara becoming India’s second-largest employer.

However, Roy and the Sahara Group encountered legal troubles and controversies, particularly regarding financial irregularities.

In 2014, the Securities and Exchange Board of India (SEBI) mandated Sahara to reimburse billions of dollars to investors, accusing the group of raising funds through illicit financial instruments.

Roy faced arrest in 2014 but was granted parole in 2016.

Unfortunately, he passed away in 2023 after falling ill and failed to reach his billionaire heights again.

Ramalinga Raju

Indian businessman Byrraju Ramalinga Raju founded Satyam Computer Services and held the positions of chairman and CEO from 1987 to 2009.

Raju resigned after confessing to embezzling £1.1 billion, including £776 million of fictitious cash and bank balances.

His fraudulent actions led to the collapse of Satyam Computers and his subsequent conviction for corporate fraud in 2015.

Following his conviction, Raju and other guilty parties were granted bail by a Hyderabad special court on May 11, 2015.

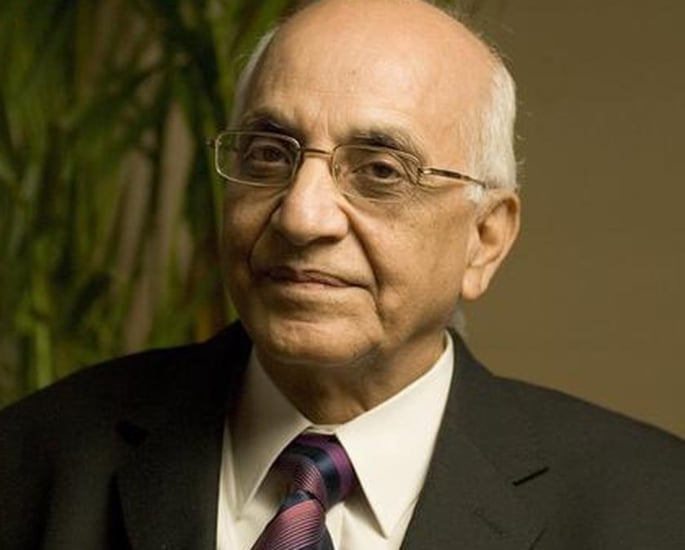

Ramesh Chandra

Once valued at over £8 billion during his peak in 2007, Ramesh Chandra is still striving to reclaim his billionaire status.

His real estate venture, Unitech, established in 1972, faced turmoil after becoming entangled in a telecommunications corruption scandal.

This resulted in his younger son, Sanjay, serving a seven-month prison sentence.

Unitech resolved a prolonged dispute with partner Telenor by agreeing to divest close to one-third of its stake in their joint venture, Uninor, to the Norwegian company.

Seeking to alleviate its £776 million debt burden, Unitech reportedly discussed with private equity firms to sell off its two special economic zones and an IT park.

In 2012, Forbes stated that Chandra’s net worth was around £540 million.

The real figure is still unknown but emphasises the drop off in Chandra’s wealth.

As the stories of these former billionaires come to an end, they serve as stark reminders of the transitory nature of accomplishment and the risks that come with unfettered ambition.

Each character’s path shows the intrinsic fragility of riches and the unexpected vagaries of fate.

As India’s economic environment shifts, these narratives serve as a warning, guiding the next generation of entrepreneurs towards sustainability, resiliency, and integrity.