Yes Bank is the first to issue Green Infrastructure Bonds in India.

Yes Bank, India’s fifth largest private bank, has signed a landmark deal with the London Stock Exchange (LSE) on January 19, 2016.

It formalises the ‘Memorandum of Understanding’ (MoU) signed with LSE, during Prime Minister Narendra Modi’s visit to the UK in November 2015.

The deal aims to develop bond and equity issuance with a particular focus on Green Infrastructure Finance.

As part of their collaboration, Yes Bank confirms plans to:

- List up to US$500m (£348m) Green Bonds on London Stock Exchange by December 2016.

- Raise equity capital through Global Depository Receipts as part of its overall US$1bn (£696,000,000) of equity capital through global depository receipt listing, basis market conditions.

India’s government has a dedicated focus on renewable energy, with an aim to deploy an additional 175 GW of generation capacity by 2022. Hence, the sector will require significant and structured financing.

As a result, there has been a rising demand for innovative means to support various projects in developing renewable energy and energy efficiency.

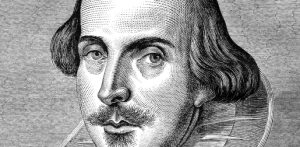

Rana Kapoor, the founder, managing director and CEO of Yes Bank, comments at the signing:

“Following the historic visit of Prime Minister Narendra Modi to the UK, the Yes Bank-LSEG strategic MoU presents an incredible opportunity to create mutually beneficial partnerships.

“Yes Bank will strive to improve the access to long term overseas funds for corporations in India, through capital markets in the UK particularly towards Green Infrastructure Financing, which is high on India’s agenda.

“We also look forward to working with LSE in establishing London as the leading instrument for raising rupee denominated offshore capital via ‘Masala bonds’.”

“London Stock Exchange is a natural partner for Yes Bank for their significant debt and equity issuances and as a partner for their clients.

“We are honoured to welcome Mr. Rana Kapoor and his team from Yes Bank to sign this important MoU which demonstrates our commitment to supporting the raising of green capital for India.”

Yes Bank is a catalyst for Green Infrastructure, being the first to issue Green Infrastructure Bonds in India and encourage investment in renewable projects.

Not only is it the first of its kind to make a commitment to funding 50,000 MW of renewable energy, Yes Bank also commits to ‘Building the Best Quality Bank of the World in India’ by 2020.