"failing to pay tax on a grand scale like this was not an administrative error."

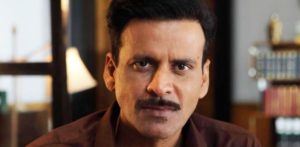

Glasgow restaurant bosses Sukdev Gill, aged 55, and Inderjit Singh, aged 47, have been banned from running a company for a total of 17 years after hiding over £4 million in taxes.

The businessmen launched their Cook and Indi’s World Buffet empire in 2010.

They were the directors of five Glasgow restaurants – Hot Flame World Buffet, Coin De Indes Buffet Limited, Experience India Limited, Salut E Hind and Seeye Diamonds.

But an investigation discovered that 19 limited companies, which they had set up were involved in some form of tax misconduct, including under-declaring tax, failing to register for VAT and concealing tax owed.

Gill signed a disqualification undertaking for eight years after he caused companies he was a director of to hide VAT resulting in a loss of £1.97 million over a period of six years.

Singh was banned for nine years after he traded through successor companies, while also concealing VAT resulting in a loss of £4.37 million.

The restaurant bosses had set up five companies between 2010 and 2012, however, all ceased to exist by March 2018.

Each company entered into a form of insolvency, either through compulsory liquidation or Creditors Voluntary Liquidation.

After the liquidation, HMRC looked into the companies and found that all five were involved in either under-declaring tax, failing to register for VAT and concealing tax owed.

Singh then continued the activities of the five liquidated companies by incorporating new companies, all trading as ‘Cook and Indi World Buffet.’

But the 14 new companies entered insolvency. HMRC made enquiries into the companies and found that Singh allowed the restaurant businesses to hide millions of unpaid tax from HMRC.

Robert Clarke, Chief Investigator for the Insolvency Service, said:

“Concealing and failing to pay tax on a grand scale like this was not an administrative error.

“The two directors knew exactly what they were doing and not only did the exchequer lose out, but their businesses gained an unfair advantage over their competitors.

“Sukdev Gill and Inderjit Singh have received substantial bans, which will significantly curtail their activities.”

“This should serve as a clear warning to others that if you fail to observe your statutory duties as company directors then the penalties are severe.”

Glasgow Live reported that the former restauranteur’s bans come into effect on September 20, 2019.

They will not be allowed to be involved, directly or indirectly, in the formation, promotion or management of a company without permission from a court.