Part of being Desi is being able to spot a bargain from a mile off

Being a student can be a worrying time when it comes to money management.

Alongside tuition fees and course books, for those living away from home, there is also the headache of rent and utility bills to think of.

Luckily, student finance can be a huge help to those struggling to pay their way through an extortionately over-priced university education.

Aside from loans to pay tuition fees, maintenance loans are also available to ensure that students stay afloat each semester.

But as with any 18 or 19 year old British Asian, managing a lump sum of cash three times a year requires strict regulation and restraint.

To prevent your student loan from vanishing as soon as it hits your bank account, DESIblitz have come up with a few top tips on how to make the most of your student loan as a British Asian.

Stock up on Mum’s Cooking

For those British Asians living away from their mum’s lovingly home-cooked meals for the first time can be a traumatising experience.

But the great thing about having a Desi mother is her innate need to make sure you are well fed, no matter what part of the country you live in.

Take full advantage of this! Let her cook you enough food to feed an army. You can store large amounts away in a reasonable sized freezer for weeks on end.

From aloo parathas, to ice cream tubs of daal, to your favourite keema dish, Desi food can be frozen and defrosted at a moment’s notice. You’ll never have to worry about what kind of cheap and unappetising pasta sauce to buy again.

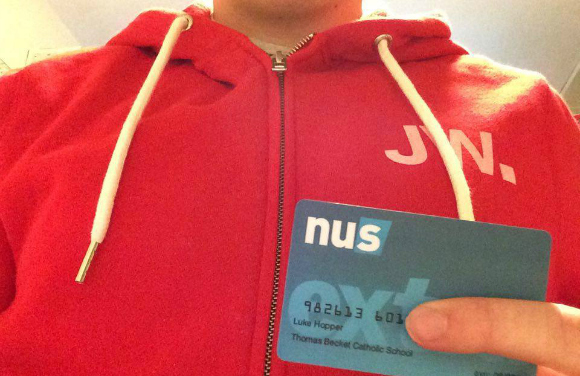

Use Student Discount Everywhere

Part of being Desi is being able to spot a bargain from a mile off. As a student you have an excuse to show this off in full force – to the envy and admiration of your non-Asian friends.

Student discounts are perhaps the single saving grace of university life.

With an NUS extra card you can pretty much get a discount off of anything. From beauty cosmetics, to restaurant offers, to cheap cinema tickets – the list is pretty endless.

You can even shop at your favourite high street stores with 10 per cent off, or bag cheap holidays around the world.

The beauty of student discount is that you don’t have to spend a lot to enjoy the full university experience.

As long as you can find out which discounts you are entitled to, we’re pretty sure you’ll never have to pay full price for anything during your three years as a student.

Buy a Student Railcard

For any 18-year-old British Asian getting their hands on their first car, persuading them to avoid driving is near impossible.

But while the pleasure of driving from door to door is tempting enough, having a car at university isn’t the most practical.

Not only do you have to worry about car maintenance costs and high petrol prices, if you are in a big city, you will have to also deal with heavy traffic and extortionate parking.

While it’s great getting to and from your parent’s house during weekends and holidays (especially for the Desi food and freshly washed laundry you can bring back), use it sparingly when you are at university.

Take advantage of public transport. A 16-25 railcard is an incredibly useful item, giving you 1/3 off public transport.

If you really hate the idea of public transport, try an even cheaper and more environmentally sound option – walking!

Stick to a Budget

When your student loan rolls in, it’s important to not spend it all at once.

The first few weeks can feel absolutely amazing and you’ll be eager to splurge anywhere and everywhere. But if you’re not careful, a week before the semester ends can be an awful experience if you don’t have any more money in your bank account.

As hard as it sounds, plan out a weekly spending budget that includes travel, food, snacks, parties, books etc. Once you’re happy with it, stick to it!

If you’re routine is pretty spontaneous, then try splitting your loan equally for each week and manage that way.

Putting a cut of your student loan aside is also a great way of saving, and can help avoid any unexpected expenses like a high electricity bill, or a library fine.

Avoid Expensive Nights Out

The wonderful thing about being a university student is the independence it brings.

You no longer need to worry about Asian parents and their curfews or going out more times than you should.

While we don’t want to hinder your university escapades, it’s important to party smart.

Avoid indulging in expensive nights out. Look for bars and clubs with special student offers, like £1 drinks before midnight.

You can also round up your friends to enjoy a few vodka and Redbulls at home before going out so that you don’t need to spend much more to have a brilliant time.

Alternatively, go for an even cheaper (albeit messier) option such as a BYOB house party.

Find a Part-Time Job

If you are still struggling to make ends meet even with your student loan, then part-time work may be the answer.

While looking for jobs in an around the city you’re in shouldn’t be too hard, you can also seek out your student career centres for job listings.

They should have vetted these and they can vary from admin, retail, catering, to even tutoring.

Working alongside studying might be difficult, but it will help you to become more responsible and organised. And that is never a bad thing!

Whatever options you have before you, going to university doesn’t have to be overly expensive.

With a little bit of smart pre-planning, you can make the most of your student loan as a British Asian.